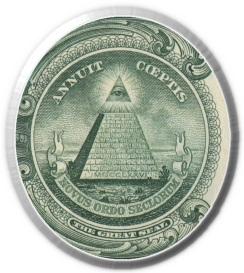

Parapolitics update: monetary hegemony

Mmmm...love that word. So I have been thinking alot about the rush to confront Iran over its nuclear aspirations and how it comes a decade before they would have operational nukes. Something about the premature timing of this seemed to about more than the mid-term elections. Then I had another tangential even that made me wonder what is really going on.

Mmmm...love that word. So I have been thinking alot about the rush to confront Iran over its nuclear aspirations and how it comes a decade before they would have operational nukes. Something about the premature timing of this seemed to about more than the mid-term elections. Then I had another tangential even that made me wonder what is really going on.I read an interesting theory today about this: Iran has a free-trade zone on the island of Kish in the Persian Gulf. Since 2003, they have been planning to build an International Oil Bourse in this free trade zone, to open around March 2006. But security and the appointment of a new oil minister for the new Iranian president delayed its opening it seems. Due to "technical glitches", according to the Ministry of Petroleum, the launch was postponed, with no new date set. What makes the IOB controversial to US interests is its stated goal to be used as an international marker for the trading of petroleum in euros, not dollars.The three current oil markers (pricing mechanism for oil) are US dollar denominated, which include the West Texas Intermediate crude (WTI), North Sea Brent Crude, and the UAE Dubai Crude. The two major oil bourses are the New York Mercantile Exchange (NYME) in New York City and the International Petroleum Exchange (IPE) in London. The Iranian Oil Bourse would establish a fourth 'oil marker', denominated by the euro. The major countries holding petroleum reserves since the decline of US production are dominated by OPEC, and hence, OPEC may choose dollars, euros, yen, or any currency providing perceived advantage, politically or economically. As of 2005, OPEC continues to trade in petrodollars, but some OPEC members (such as Iran and Venezuela) have been pushing for a switch to the euro.

This would be a nightmare for the Federal Reserve because: international buyers will have a choice of buying a barrel of oil for 60 dollars on the NYMEX and IPE-- or purchase a barrel of oil for 45-50 euros via the Iranian Bourse. This assumes the euro maintains its current 20-25% appreciated value relative to the dollar-- and assumes that some sort of US "intervention" is not launched against Iran. The upcoming bourse will introduce petrodollar versus petroeuro currency hedging, and fundamentally new dynamics to the biggest market in the world-- global oil and gas trades. In essence, the U.S. will no longer be able to effortlessly expand credit via U.S. Treasury bills, and the dollar's demand/liquidity value will fall. This, combined with the Fed's decision to discontinue publication of the monetary aggregate M3, make alot of people suspicious. parapolitics at work...

Español | Deutsche | Français | Italiano | Português| Ch| Jp| Ko

0 Comments: